-

Simplify complex financial processes and leverage data to make strategic decisions

-

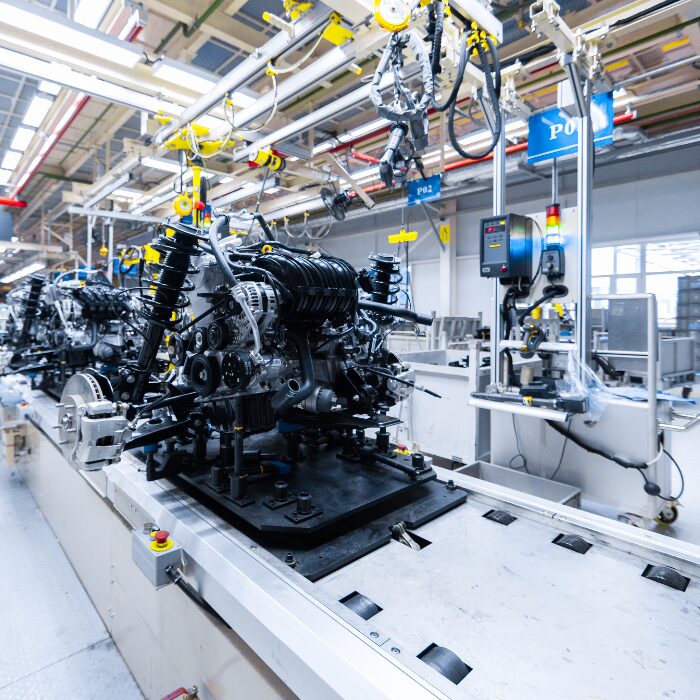

Tailored budgeting, planning, forecasting and close process solutions for every industry

- Resources

Stay informed and inspired with expert advice, helpful tips, success stories, and industry news and trends

Resources