If you’ve heard the name BlackLine batted around in accounting circles, but weren’t sure what it is, you’re not alone. Many CPAs that we’ve spoken with haven’t heard of this product before or have heard the name but that’s it. Here is a brief summary of what BlackLine is, and more importantly why you should consider using it.

What is BlackLine?

BlackLine is software as a service (SaaS) platform that provides a system for performing multiple month-end accounting processes in one place. BlackLine’s current offerings include modules for account reconciliations, variance analysis, consolidation validation, task completion, two different journal entry processes and transaction matching. In addition, BlackLine recently introduced options for simplifying intercompany transactions and compliance testing and documentation. In a nutshell, BlackLine replaces the common practices of spreadsheet documentation and manual procedures for many key accounting processes.

As mentioned above, BlackLine solutions contain various products, with the most common being account reconciliation and journal entry documentation. Through these products information is uploaded into BlackLine from the underlying general ledger system where users are then assigned the responsibility of providing support.

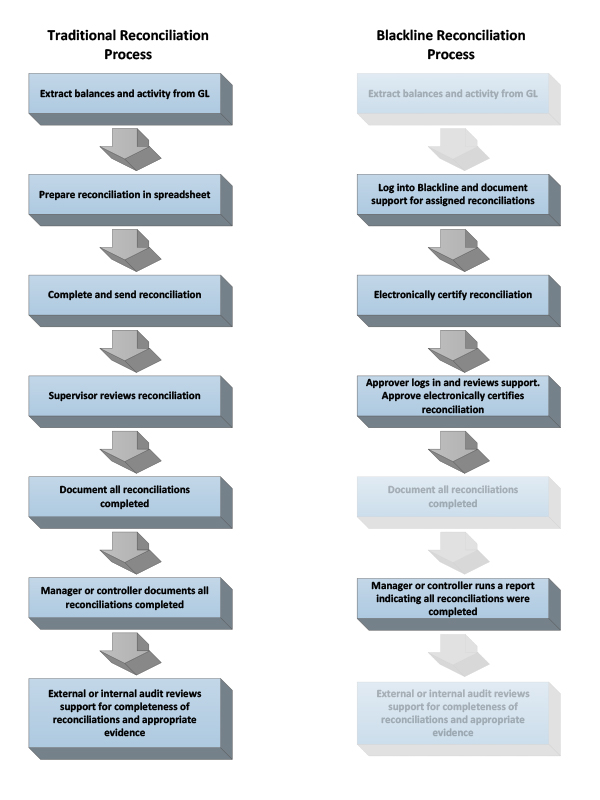

As way of comparison, the following diagram compares the typical account reconciliation process in the traditional method to the typical process in a BlackLine instance.

Why should you consider BlackLine?

As you can see in the example above, BlackLine improves the account reconciliation process by automating the load of account balances from the source ledger, notifying supervisors that reconciliations are complete and ready for their review, storing support in a single location, providing evidence of review and approval, and incorporating segregation of duties controls necessary to ensure the integrity of the reconciliations process. This type of streamlined process is consistent with all of BlackLine’s modules.

While a strong reconciliation process is important for all entities, private or public, public entities (or entities subject to annual audits) can leverage BlackLine as a repository for reconciliation and journal entry support. External and internal auditors may be granted access and are able to review support that has been completed and made available for inspection.

Because BlackLine is a SaaS offering, the client hardware requirements do not extend past having appropriate workstations for employees with internet access. This, combined with the BlackLine standardized implementation procedures, results in minimal involvement from the IT department. A typical implementation of the BlackLine Account Reconciliations may be completed in as little as two months. BlackLine can be managed with a minimal amount of administrative time and is typically handled by the accounting group.

Few products offer as much return with a nominal investment. For more information regarding any of the BlackLine products or our service offerings related to BlackLine, please email us at info@sandpointc.com.